Content sponsored by:

Hangzhou DE Mark Industrial Co Ltd

Vitamin & amino acids highlight

Published: December 10, 2018

By: Ronnick FONG. HUZHOU INTERNATIONAL TRADE CO LTD

Vitamin A

Newsletter, Dec 08, 2018

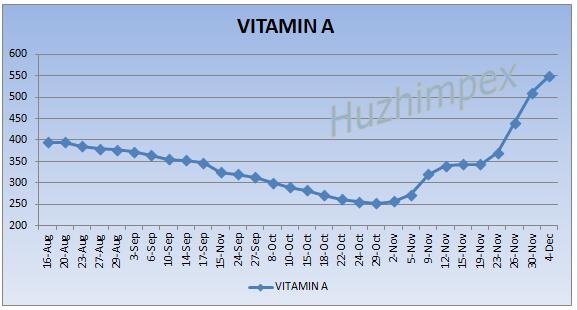

In November, the crazy market was of invincible Vitamin A. Due to the shortage of supply, the monthly increase was about 111%. As of December 4, the domestic market price was offered 540-560 yuan/kg (see the figure above), and at European VA1000 market the price was rebounded from 61 euros per kilo to 80-85 euros per kilo,or even higher. The fourth quarter was originally the peak of the annual export, and this year, it encountered the supply reduce by the manufacturers.

Affected by abnormal weather, the water level of the Rhine River was significantly reduced since early August this year. In November, the lowest water level in history was refreshed. This resulted in severe restrictions on the transportation of raw material barges at the production base in Ludwigshafen, Germany,thena many chemical raw materials were blocked. BASF stated on November 26, that the company temporarily stopped the production of TDI at the Ludwigshafen plant due to the low water level in the Rhine. As early as August 3 this year, the phthalic anhydride production facility located downstream Ludwigshafen has been closed, and the downstream plasticizer products thus have been in a state of force majeure.

The manufacturer has not made a clear and definite announcement on whether it affects Vitamin A production, but recently there have been reports from overseas media that BASF vitamin raw materials have encountered production problems. According to the market report, the supply of Vitamin A products by BASF China was greatly reduced, along with the limited supply quantities of Vitamin E, all of which confirmed the supply problems of BASF. In addition, the market news that the domestic Vitamin A oil plant, due to equipment recovery problems, production time is prolonged and the time for production resuming is temporarily uncertain, which is undoubtedly worse for the tight Vitamin A market.

However, a BASF spokesperson confirmed on December 4 that the rains in the past few days have led to an improvement in the water level of the Rhine, enabling BASF to supply raw materials to its Ludwigshafen plant. At meanwhile, the spokesperson added that it will take some time before all processes are back to normal.

After the Spring Festival (20/Feb/2019), the tight supply will gradually ease, and it is necessary to pay attention to the updates of domestic and foreign manufacturers.

Other vitamins

Folic acid: Since Nov 15 to Dec 6, four leading folic acid manufacturers announced price rise of folic acid.

d-Biotin: Nov 26, Tianxin Pharmaceutical raised its ex-factory price.

Vitamin K3: Nov 15, Miangyang Vanetta raised ex-work price, and on Nov 27, Chongqing Minfeng announced a 4-week maintenance during Dec/2018-Jan/2019.

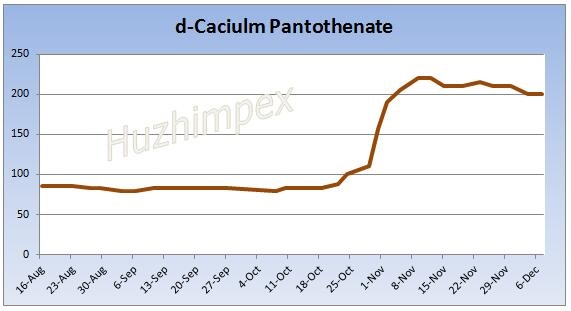

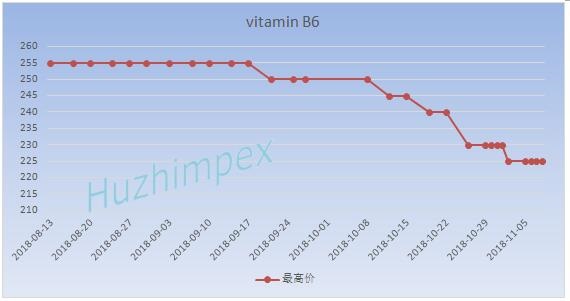

In addition to Vitamin A quotation has doubled since the beginning of November, the vitamin market is madly reappearing, of which d-Calcium Pantothenate soared 100RMB a week. On November 21, BASF increased Vitamin E price to 48 RMB/kg, the market purchase and sale were turning active, the quotation rebounded,Vitamin K3, B2, D3, folic acid, biotin, and etc., also showed a certain increase in price, while vitamin B1, B6, C and choline chloride have a callback (see the figure below).

This year's autumn and winter air management plan proposed that industrial enterprises implement differentiated peak production, and in heavy pollution weather, the enterprises implement urgent control to limt or stop production. In winter, the haze weather is very often. the pressure of environmental protection is great, the operation of domestic chemical companies is then resitricted. In the fourth quarter, China’s vitamin exports are strong, domestic supply shrinks, and more manufacturers delivery becoming tight. As being supported with stocking up before the year end and significant exports, the overall vitamin market in December showed a strong trend.

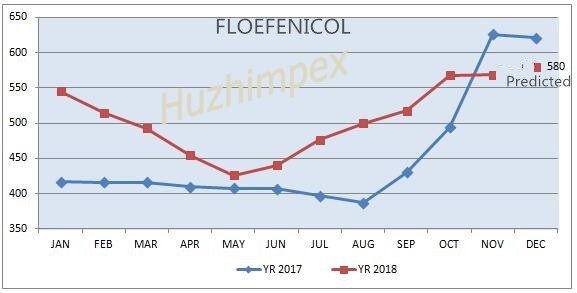

ANTIBIOTICS --Florfenicol

The rising price of D-ester and environmental protection are the incentives to push the price increase of florfenicol. It is understood that D-ester is mainly produced in the north of China, production is limited in winter, and the output of major manufacturers declines, resulting in D-ester price rise. Although the recent price of florfenicol has gone down a little due to traders' clearance, market supply has still been in a state of tension. Affected by environmental protection, Shandong Guobang Pharmaceutical Co., Ltd., located in Weifang, began to suspend production, which boosted (price)confidence in the florfenic market. In addition, compared with the same period of last year, the current price of florfenicol is still lower. With the arrival of the stocking season at the end of the year, the possibility of price rebound continues going up.

We supply the following Florfenicol products:

- Florfenicol pharma grade 98%

- Florfenicol 4% microencapsulated

- Florfenicol 5%/20% coated water dispersible

- Flrofenicol 15% injection

Source

Ronnick FONG. HUZHOU INTERNATIONAL TRADE CO LTDRelated topics:

Mentioned in this news release:

Recommend

Comment

Share

Recommend

Reply

Recommend

Reply

21 de diciembre de 2018

Please show plants extracts that can be used to control coccidiosis in poultry feed.

Recommend

Reply

Agrited

21 de diciembre de 2018

The other option that the price will be determent after our (premix producer) lab test

Recommend

Reply

Recommend

Reply

21 de diciembre de 2018

This so true chain has issues with partners.let them come and we are ready to work together.

Recommend

Reply

21 de diciembre de 2018

Dear Fong

Good piece of information and analysis on the world vitamin supply although most of the European companies are buying from China, but for Chinese's product quality issues are still theirs. Sometimes it is hard to justify the cost with quality and buyer always go with the European brands of product.

I think and suggest that Chinese companies need to make an association and come out to the different countries and meet the buyers show them quality certification and Iso certifications and let them know you are equally good companies in China which supply quality products.

Thanks

Zahid

Recommend

Reply

Would you like to discuss another topic? Create a new post to engage with experts in the community.