Global Animal Feed Additives Market will be worth over $22bn by 2022

Published: February 21, 2017

By: http://www.beststockmarketnews.com

The animal feed additives market size, worth USD 16.11 billion in 2014, is expected to grow at a CAGR of 3.7 % over the period of 2015-2022. Rise in meat consumption of livestock such as poultry, cattle, and swine as a protein source is expected to boost the global industry trends over the coming years.

Animal feed additives such as minerals, vitamins, fatty acids, and amino acids enhance metabolism and weight gains of the livestock. Livestock production estimated at 305 million tons in 2014, is expected to increase significantly over the coming years and will drive animal feed additives market growth.

Furthermore, increase in meat consumption due to growing purchasing capacity and population base is expected to drive the global animal feed additives industry size over the next few years. Asia Pacific meat production sector contributed over 41% of the overall demand in 2014, while Europe and North America meat production industry contributed over 18% and 14% of the overall demand in 2014.

Based on the livestock, animal feed additives market is segmented into cattle, poultry, swine, and aquaculture. Animal feed additives market share in poultry, worth USD 6 billion in 2014, is expected to witness high surge over the coming timeframe. The growth can be attributed towards rising health awareness along with strict monitoring of meat quality by the government due to increasing occurrence of diseases such as bird flu, etc. Animal feed additives industry size in aquaculture is expected to record a CAGR of 4.2% over the coming six years.

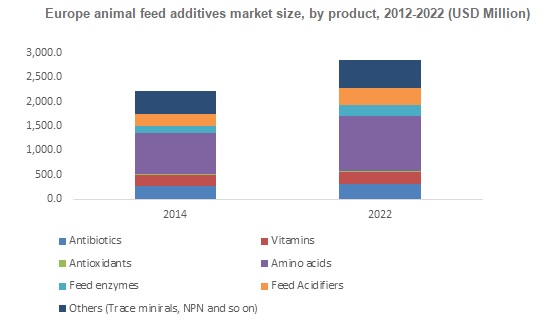

Amino acids market price, valued at USD 5.3 billion in 2014, is expected to grow significantly over the coming years. The growth can be credited to the use of threonine, lysine, methionine, and tryptophan in feed additives of poultry and swine.

Asia Pacific animal feed additives market revenue, worth USD 5.1 billion in 2014, is projected to witness a substantial growth over the coming six years. The growth can be attributed to rapid urbanization, strong economic development and increase in purchasing capacity of the consumers. Philippines, India, China, Thailand, Malaysia, and Indonesia are expected to be the major regional revenue contributors.

Latin America animal feed additives industry size, which contributed over 8% of the overall revenue in 2014, is anticipated to witness a substantial surge over the coming years. The growth can be credited to high standards of living, rising disposable income of the consumers, and high demand for meat. Argentina and Brazil are anticipated to contribute significantly towards the regional share.

Market players will try to increase their product portfolio and grow their regional presence through mergers & acquisitions. Key industry participants include BASF, Danisco Company, Nutreco Company, Evonik Industries, Addcon Group, Adisseo, Cargill Corporation, Biomin Company, and Kemin Industries.

You can browse key industry insights spread across 108 pages with 53 market data tables & 12 figures & charts from the report Animal Feed Additives Market in detail along with the table of contents:

Source

http://www.beststockmarketnews.comRelated topics:

Recommend

Comment

Share

Soavet

22 de febrero de 2017

Excellent and very educational article but with detailed emphasis on European market ,but had provided a good guide for countries studies or regional Animal feed additives market evaluation

Thank you for the submission

Recommend

Reply

Phytobiotics

21 de febrero de 2017

This is an excellent article! We see the growth in acidifiers even more dynamic. Both applications as feed preservative and feed additive have been growing very fast for the last few years. This growth is expected to accelerate due to a rising demand in quantity and quality of meat.

Recommend

Reply

24 de junio de 2020

Thanks for this great article. but I think CoVID 19 has its commercial and nutritional impact on the feed additive use and proud action as well. Most of the Asian and world other countries the feed production has been decreased by 20-25% and so does the animal production such as chicken

If so these numbers need to revised for these 2 years 2020-2022. Please let me know if you agree

Regards

Zahid

Recommend

Reply

2 de marzo de 2017

Thank you for great article and lots of very valuable resources. We always need feed addives market size and trend.

Recommend

Reply

Food & Allied Group of Companies

23 de febrero de 2017

It is an opportunity for the African countries to invest in the production of feed additives.

Recommend

Reply

Behn Meyer

23 de febrero de 2017

It is predictable because antibiotic uses in animal production has been banned in many countries and there is a rising alert for antibiotic resistance in food chain. Therefore, feed additives, especially products for improvement in animal metabolism, health, and immunity, will be an absolute antibiotic alternative, but for effective and reliable application, each suppliers, feed producers, and farmers must find a potential combination of many type of these products such as synbiotics, or probotic plusing acidifiers, or oligosaccharides. In the future and sustainable development, the business will be promising for any players.

Recommend

Reply

Would you like to discuss another topic? Create a new post to engage with experts in the community.