The Continuing Demand for Sustainable Fishmeal and Fish Oil in Aquaculture Diets

The reason why they have proved so popular in aquaculture is that both fish-meal and fish oil have unique nutritional properties. In the case of fishmeal these properties include a high protein level, ideal amino acid profile, high digestibility, lack of anti-nutritional factors, high palatability and wide availability.

For fish oil they include high palatability, rich in essential omega 3 fatty acids and limited other users. This has meant that these two marine derived ingredients have been shown to consistently produce the most economically efficient diets, while also resulting in healthy animals which in turn yield healthy seafood products.

However, as aquaculture expanded worldwide, it absorbed increasing volumes of both fishmeal and fish oil. This has led some people to the view that the future growth of aquaculture will be limited by a shortage of marine ingredients.

Conversely, others have predicted that concern over the sustainability of fishmeal and fish oil, as well as rising prices, will result in decreased use of these ingredients in aquafeeds in the future.

In this article I intend to examine the drivers behind the use of fishmeal and fish oil and try and answer the question as to what role they will play in future aquaculture diets.

The setting of more precautionary quo-tas may in time result in higher catches, but the trend towards increasing use of catches for human consumption is likely to persist. Therefore, the outlook for future avail-ability of fishmeal and fish oil is that supplies are likely to remain tight, particularly since there are unlikely to be any new resources to be exploited.

However, the one growth area in terms of supply is the use of fisheries by-products such as viscera, heads, frames and filleting waste for the production of fishmeal and fish oil.

The higher prices now being achieved for protein meals and food/feed oils, plus increas-ingly stringent rules on the disposal of fisher-ies waste, has resulted in more and more of this raw material being made available for processing. IFFO now estimates that nearly 25% of the global production of fishmeal comes from fisheries waste – this includes meals coming from aquaculture by-products.

Table 1 shows the production of fishmeal by country in 2007 with an indication as to the main raw material sources used.In conclusion, on the supply side pro-duction of fishmeal and fish oil is likely to remain relatively constant except for periodic downturns due to El Niños in the South Pacific.

The very rapid in the fishmeal usage in poultry diets since the 1980s can be attributed to nutritionists finding alternative ingredients that gave equivalent performance at a lower cost. The reduction in its usage in pig diets was much slower because most of the fishmeal was in weaner diets for young pigs, and this has proved much harder to replace.

Sprayed dried milk proteins are obvi-ously good alternatives but their price is usually even higher than that of fishmeal. So this increasing market-share being taken by aquaculture has led some to speculate that growth in aquaculture will soon be constrained by the availability of fishmeal.

We can look at the larg-est grouping, salmonids, in a bit more detail; during the period 2000-2008 the global production of all farmed salmonids grew by around 47 percent (from 1.5 to 2.2 million tonnes) while the use of fishmeal in this market grew by only around seven per-cent (770,000 to 820,000 tonnes).

Two critical things then hap-pened, firstly more and more margarines were produced from vegetable oils, as this was seen as more healthy. Secondly salmon farming production really took off. The result was that the price of fish oil fell with the loss of the margarine market. This made it doubly attractive to the salmon feed industry as it was both cheap and ideal for inclusion in feeds.

For most of the period 1999 to 2006 the price of fishmeal remained in the US$400-600/tonne area but then, mostly as a result of strong demand from China, the price suddenly increased to around US$1200 causing shockwaves through the market. This can be clearly seen in the ratio of fish-meal price to soymeal price. This rose to unprec-edented levels, greater than 6:1, following years of being around the historic level 3:1.

Consequently, since the begin-ning of 2008 the price of fishmeal has been rela-tively low when compared to the price of soymeal, indicating that once again fish-meal represents good value for money and supply is, if anything, above required demand. There is certainly no evidence here that there is insufficient supply to meet the demand of a growing aquaculture industry.

In 2008 the price of all oils rose globally and this was particularly true of fish oil. This led many feed formulators to replace fish oil with vegetable oils. However, in late 2008 it became appar-ent that the disease problems in the Chilean salmon industry were more serious than many had thought and production volumes have declined sharply. Given the importance of the salmon feed market to fish oil, the combined effect of substitution and reduced demand resulted in the price decreasing rapidly. Soon the ratio of fish oil to rape oil hit a low of 0.5:1. However, once again market forces resulted in a rapid move back to fish oil again, particularly in salmon diets. As was the case with fishmeal, there is no evidence that the aquaculture industry has been restrained by the availability of fish oil.

The biggest concern with this approach is, however, that the farmed products pro-duced using dietary vegetable oil, rather than fish oil, are going to be much lower in the healthy very long chain PUFAs, EPA and DHA.

Given the growing body of scientific evidence as to the importance of higher intake of these fatty acids and the consum-ers’ growing realisation that seafood is one of the best sources of EPA and DHA, aqua-culture could endanger the healthy image of its products with the indiscriminate and excessive substitution of marine oils with vegetable oils.

This question is equally valid when asked of soymeal and palm oil as it is of fishmeal and fish oil. The immediate question is what does sustainable mean, particularly in the context of fisheries and fisheries management.

And please keep in mind, as one of the previous speakers mentioned, the necessarity to keep a certain acidic pH when working with phytases. It had been several times documented in livestock, as well as recently in aquaculture (trout) at the University of As in Norway that the combination of acidifier and phytase act synergistically in improving performance parameters of fish. The use of organic acids in aquaculture has anyway lately gained interest, as the increasing amount of publications show. And again... as discussed a while ago, the use of acidifier in fish diets shows next to the effects on performance and bacteria promising results on digestibility - among them protein (nitrogen), calcium and phosphorus... thus coming back to the original topic of this forum:-)... sustainability.

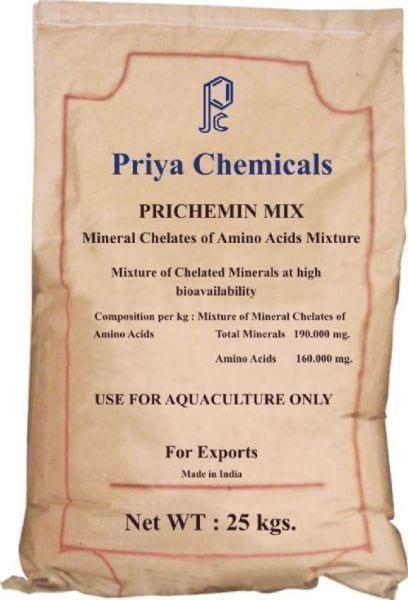

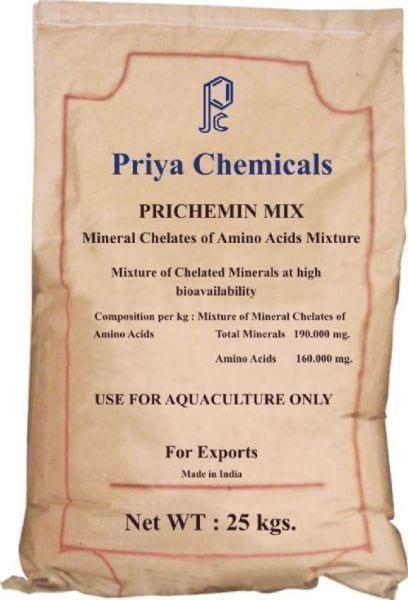

PRICHEMIN MIX

Fishmeal and fish oil have been and will continue to be vital ingredients in many types of aquaculture diets. Although supplies are likely to remain tight the various sectors of aquaculture will be able to grow by complementing the marine ingredients with ingredients from other sources and this will result in lower inclusion levels of both fishmeal and fish oil.

Now there are many alternatives for fish meal to be used in the aqua feed such as algae and some plant proteins with supplements.

Algae is a good alternative source for fish meal in aqua feeds, One fundamental consideration is that algae are the base of the aquatic food chains that produce the food

resources that fish are adapted to consume. But often it is not appreciated that the biochemical diversity among different algae can be vastly greater than among land plants, even when ‘Blue-Green Algae’ (e.g. Spirulina), more properly called Cyanobacteria, are excluded from consideration.

Fishmeal is so widely used in feeds largely thanks to its substantial content of high-quality proteins, containing all the essential amino acids. A critical shortcoming of the crop plant proteins commonly used in fish feeds is that they are deficient in certain amino acids such as lysine, methionine, threonine, and tryptophan (Li et al. 2009), whereas analyses of the amino acid content of numerous algae have found that although there is significant variation, they generally contain all the essential amino acids.

Yes, I too echo with the benefits of enzyme applications into aquaculture feeds. The enzyme efficacy & consistent performace depends on the technology on which it is produced and its temperature resistence (Feed process) & pH tolerence. Alltech's Allzyme SSF is a complex enzyme, produced under solid state fermentation method and we guarantee for seven enzymes but there more than hundred enzymes!!!!!. SSF has been proven very effectively that the performance of fish in low fish meal based diets and high fish meal diets are same. And we have noticed that there is significant reductions in the FCRs in the low fish meal inclusion diets upto by 13% reductions in FCR and 10% increase in the ABW. India is witnessed with a lot of extruded fish feed mill and extrusion itself provide some space to go upto 8 to 9% though process technology may not interfere at this level but fish might encounter problems of poor digestion. In these conditions enzyme application is a perfect way to make use of that opportunity.

PRICHEMIN MIX

I do not know about the type of phytase that is being employed in the fish feed industry. But it is worth for use in tropical fish diets. However, when it comes to temperate fish diets and use of phytase, I am unware of its efficiency. If the phytase is to be active it is the pH that is imporatant and hardly any difference exist between the phytase manufatured by dffferent companies. Some are active at wide rane of acidic pH while other at narrow range of acidic pH.

Thank you very much for your information.

Do you think that the feed industries use the same phytase in fish than in pigs and poultry or other adapted to lower temperatures?