The “Bad Penny”

Published: October 3, 2014

By: Syed Shakil Amjid, Dairy Business Professional and Muhammad Naveed ul Haq, Assistant Professor

Dairy Farming is one of most important avenues within agribusiness portfolio of Pakistan’s economy. Despite being 4th largest milk producing country, dairying in Pakistan continues to struggle on various grounds; of which milk marketing and supply-chain is at top.

Historically, unorganized farms have existed either in backyard of village households or in dairy colonies in peripheries of metropolitans. Virtually, no commercial farming existed until 2005, after that a major investment outpouring from Non-Resident Pakistanis (NRPs) and locals was done in response to massive mobilization and dairy-friendly policies adopted by Government.

As a result, a sizeable number of commercially oriented medium sized farmers’ class emerged. The attire of dairying started changing with import of high producer cows, mechanization in milking, feeding system and advisory services. Dairy farming attracted local industrialists as well; being tax-free money-spinning segment, business tycoons’ invested heavily and setup up giant dairy empires, each with housing facilities up to 5,000 cattle and milk production of more than 25,000 liters a day.

Being novice was itself a great challenge for commercial farmers. Milk processors have had a field force with little knowledge of dairy business management, whom added to the difficulties and made it a bumpy ride for the investors. Much of time, energy and money was spent in hit and trial wizards; eventually ending up with trained manpower and gradual development of Standard Operating Procedures for this emerging business avenue.

Milk processors started offering incentives of various kinds as they were able to save significant logistics and other supply-chain costs because of sizable quantity of milk being available from a single place. This scheme was started by a multinational processor and soon adopted by other national processors. Situation was seen positive as apparently it created a win-win situation for both milk processing companies and commercial and corporate farmers. Shared value kept this relationship going on till the change in product portfolio of dairy processors.

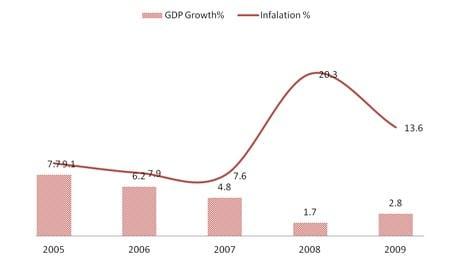

On the other hand GDP fell from 4.8% to only 1.7% giving rise to unbelievable inflation from 7% to 23.3% in 2007 and 2008, respectively. This disastrous economic performance diminished buying power of a common consumer; eventually dairy processors had to alter their course for maintaining their sales volume and continued business growth.

Initial efforts in marketing and sales strategy of companies included reduction in serving size of the product i.e. 250ml, 125ml and 65ml packs. Efforts were also done to economize the recipes of products and the rabbit drawn out of the hat was “Liquid Dairy Whitener”. This product was extensively marketed by the processors and eventually acceptance was created.

Dairy Whiteners generally substituted milk content with “Skimmed Milk Powder” (SMP) and palm oil fat. This intervention gave more control to dairy processors over their supply-chain by purchasing huge quantities of SMP from all around the world at even lower costs than national milk collection. The SMP imports being 150 thousand tons in 2008-2009 have now increased up to 350 thousand tons, a possible substitute of up to 700 tons of local milk collection.

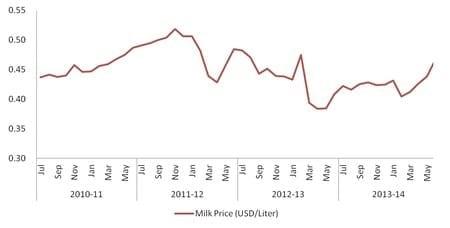

The biggest dilemma of the story is that everything ranging from animal feed to machinery etc. has gone as much as 100% costlier; whereas, milk price is still the same. For instance farm gate price in June 2014 was just 3 cents higher than that of June 2010. In a nutshell a momentous increase in operating expense has slowly but steadily pushed dairy farmers to a negative cash-flow.

Dairy processors have had a substantial contribution towards development of commercial/corporate dairy farmers. Unfortunately, system was pushed by them to produce maximum possible milk, no matter what may it cost to the farmer. On the other hand, there was no focus by farmers on alternative milk selling plan as it did not suit the processors either.

According to World Bank, 63% of Pakistan’s population still lives in villages; whereas, 70% of the milk produced at farms is consumed by the household itself, essentially translating into the fact that farm locality is not a suitable market for the farm produce and extra investment would be required to transport the milk to urban areas.

Most vulnerable in aforementioned situation are medium sized farmers, due to their higher operating cost versus relatively smaller capital and size to bear the market slump for longer. On the other hand, negligible operating expenses and self-consumption approach of backyard farmers will prove a shield against the vulnerabilities of stagnant milk market.

Sensing the situation ahead, now corporate farms are opting alternative and sustainable milk sales avenues. So far, couple of them has done it quite successfully by launching their own brands of pasteurized milk, an initiative quite overwhelmingly welcomed in urban areas. Besides greater challenge of supply-chain management, pasteurized milk has unique edge over the traditional UHT milk in terms of superior quality, consistency and high-end customers. In a nut shell, persistent imports of SMP and continued lower milk price offerings in Pakistan have set a scenario that will add more players in pasteurized milk business.

By 2020, acceptance for tea whiteners would go down and consumers are expected to use whole milk for their daily needs, “turning up the bad penny” for dairy processors in Pakistan, but by the time they would have lost torch bearers, the medium sized commercial farmers.

Authors:

Nutrimaux

Recommend

Comment

Share

Would you like to discuss another topic? Create a new post to engage with experts in the community.