Poultry Probiotics Market to surpass the billion-dollar benchmark by 2024, industry poised to witness a vibrant competitive landscape

Published: February 28, 2018

By: https://www.gminsights.com/industry-analysis/poultry-probiotics-market

Over the past few years, livestock production has increased exponentially. This has indeed made a subsequent impact on poultry probiotics market, with the increasing demand for NGPs (natural growth promoters) in animal feed. Poultry probiotics industry is strongly characterized by R&D and product innovation activities which have made this fraternity witness a fiercely competitive landscape. The industry players are constantly involved in implementing growth strategies such as global expansion and product development to sustain their market value. Below is a synopsis of the contributions by the key participants toward the growth of poultry probiotics market:

Adisseo and Novozymes

Two of the prominent global leaders in poultry probiotics industry, Adisseo and Novozymes, have launched their probiotic called Alterion, especially for poultry application. Made from all the naturally-occurring bacterium found in soil, use of Alterion in the animal feed has helped the farmers to better control the gut health of their animals. It also prevents the growth of unwanted bacteria in the digestive tract of animals and optimizes the feed conversion by 2% to 2.5%.

Both the firms are striving to expand their global reach in this rapidly developing market. In 2016, Alterion was introduced in the U.S. and later in the countries of South East Asia and Middle East.

Currently, U.S. is witnessing a strong demand for streptococcus based poultry probiotics as it increases animal weight and enhances their feed conversion. As per estimates, U.S. poultry probiotics market from the demand of streptococcus is projected to generate revenue worth over USD 25 million by 2024.

Collaboration of Novozymes and Boehringer

Boehringer Ingelheim Animal Health and Novozymes have recently created a vibrant buzz in poultry probiotics market, by announcing their plan to collaborate and commercialize probiotics for global poultry production. This, early 2017 announcement of Boehringer Ingelheim to join forces with Novozymes- the renowned biological solutions provider will enable the former to foray into animal feed additives market, which is profoundly challenged by antibiotic bans.

Stringent regulations by EU Commission and the FDA toward the ban of AGPs in animal feed have positively influenced the global poultry probiotics market trends.

The collaboration is indeed an appreciable step taken by the companies to enhance their market value in terms capabilities, product innovation, and pricing strategy. With this move, Novozymes is expected to utilize Boehringer Ingelheim’s vast network to gain access to new distribution channels and customers across the globe.

Evonik

Evonik, a leading player in poultry probiotics industry has recently (January 2017) launched its first probiotic product called GutCare PY1. The company, being a specialist in feed amino acids, plans to take the lead in the field of developing sustainable and antibiotic-free livestock feed additives. Presently, Evonik holds three probiotics in its portfolio, viz. Ecobiol for poultry, Fecinor for piglets, and the newly launched GutCare PY1. Expanding the product portfolio has complemented the company with a better accessibility to the customers at a global scale. Evonik plans to initially introduce the product in the U.S. poultry probiotics market and gradually in the Asia Pacific belt.

Chr. Hansen

Chr. Hansen is amongst one of the world’s top three manufacturers of probiotics for animals, along with Dupont and Lallemand.

The under growing pressure to use fewer antibiotics in the food chain has been an important driver for the growth of poultry probiotics market. This company is grabbing the huge opportunity from the growing demand for antibiotic-free poultry and is expanding its animal nutrition portfolio in Asia Pacific market.

Asia Pacific is one of the chief regions witnessing a phenomenal expansion of animal health industry. Countries such as Australia, South Korea, India, and China are comparatively mature in terms of usage of probiotics in feed.

As per a report, China poultry probiotics industry is projected to generate revenue over USD 250 million by 2024, owing to rising consumption of broiler meat and rise in per-capita disposable income.

Chr. Hansen is actively planning to launch its product in China & US poultry probiotics market as an alternative to antibiotics, as these countries bet big in terms of swine and chicken sectors globally.

Key insights

- The rising concerns over antibiotic usage in animal feed which poses a major threat to human health is certain to drive poultry probiotics market dynamics over the coming years.

- As the global poultry probiotics industry is highly competitive in nature, collaborations and product portfolio expansion will act as major growth strategies.

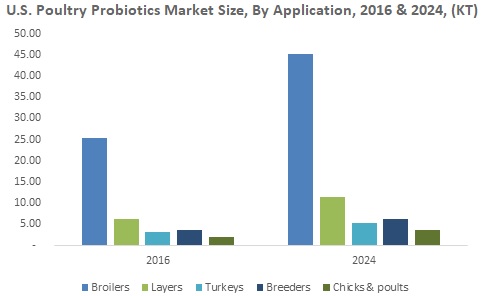

- The global poultry probiotics market is likely to witness major application scope from broilers, turkeys, and chicks & poults segments.

These trends vividly validate the potential of poultry probiotics industry in the coming years. As per a report by Global Market Insights, Inc., Poultry Probiotics Industry is projected to register a CAGR of 7% over 2016-2024, surpassing a valuation of USD 1.8 billion by 2024.

Source

https://www.gminsights.com/industry-analysis/poultry-probiotics-marketRelated topics:

Mentioned in this news release:

Global Market Insights Inc.

Recommend

Comment

Share

Would you like to discuss another topic? Create a new post to engage with experts in the community.