Content sponsored by:

Hangzhou DE Mark Industrial Co Ltd

Lookback of Florfenicol and Tylosin Prices - De Mark Newsletter

Published: March 3, 2020

By: Ronnick FONG, Executive Director at Hangzhou De Mark Industrial Co Ltd

VICTAM and ANIMAL HEALTH & NUTRITION

With the novel coronavirus continuing to spread globally, there are currently more than 35 exhibitions in Asia (East and Southeast Asia), originally scheduled 10/Feb-20/Apr, which has been postponed till July or even cancelled directly. Until the outbreak is controlled at a safe level, avoiding the gathering of people is the recommended measure in official guidelines to avoid human-to-human transmission of the virus. In consideration of the health risks of all the involved parties of the show, the organizer of VICTAM and Animal Health & Nutrition has contacted the exhibitors on 28/Feb for vote and choice. In case more than 75% of the exhibitors agree to postpone the event to 09-11/Jul, the organizer will respect the vast majority of exhibitors’ request, and take appropriate next steps, as the organizers said in their email.

Let’s wait and look…

Lookback of Florfenicol and Tylosin Prices

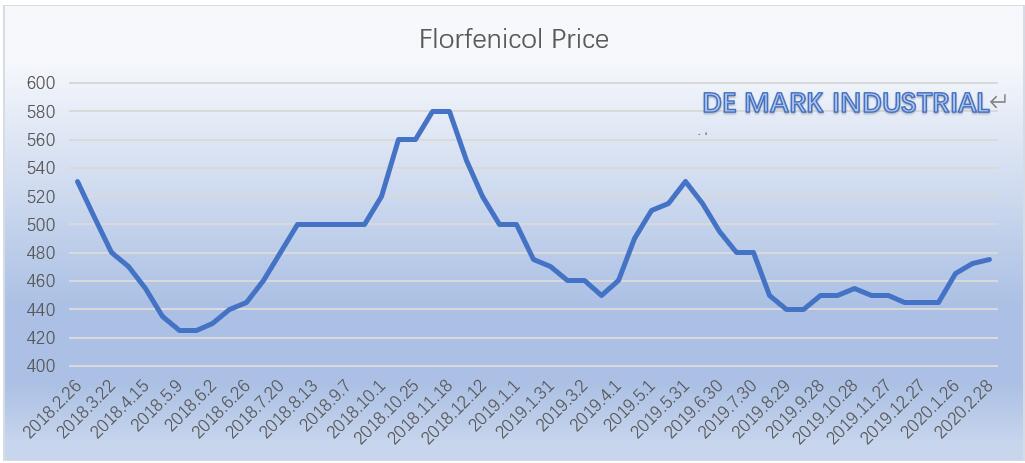

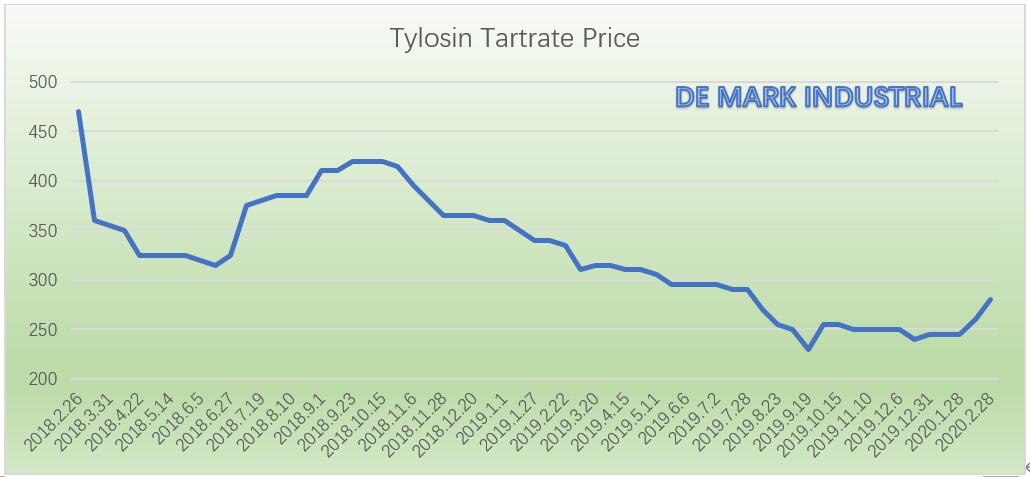

Florfenicol and Tylosin are the leading drugs applied in pig farming industry. Tylosin,at the same time, is the upstream raw material for several other animal drugs of Tilmicocin and Tiamulin. The price fluctuation of these two products is indicative for the changes in the veterinary drug market. Let ’s take a look at the price changes of these two products in the year 2018 and 2019 and what the corresponding reasons are.

First of all, the introduction of environmental inspections in the second half of 2017 has pushed the prices of veterinary raw materials to a new price level.

In May and June 2018, the prices of Florfenicol and Tylosin came down to their lowest points of the year. In June, the Environmental Protection "Looking Back Campaign" was launched, and the supply of veterinary APIs began to tense, followed by a wave of significant increase in prices. In just three or four months, Florfenicol price increased by 40%. At the meantime, Ningxia Tairui Pharmaceutical Co., Ltd., as a major supplier of tylosin and tiamulin in China, announced a complete production suspension and plant relocation due to environmental reasons. This move received a rapid response from the market. The average market price of Tylosin rose from less than RMB320 in early June to roughly RMB420 in mid-September, an increase of more than 30%.

The overall market was steadily declining in 2019, and African Swine Fever (ASF) has swept across the country from north to south, the hog inventory has shrinked, and the demand for veterinary drugs has decreased accordingly. In July 2019, the second round of central ecological environmental protection inspections started in full. The market of these two products did not respond significantly, and continued slipping down. Florfenicol price rose a bit in mid-March,that was mainly associated with insufficient supply of upstream raw materials.

At the beginning of 2020, a sudden outbreak of the novel coronavirus (named as COVID-2019 later by WHO) led to the extension of the Spring Festival holiday, exhaustion of stocks and scramble for supplies. In Hubei Province with capital city of Wuhan where the epidemic originated, a major producer of Florfenicol, Hubei Longxiang Pharmaceutical Co., Ltd., is still under blockade and shutdown, and has not yet resumed production, its stock products cannot be shipped out. The market price has risen from RMB450 before the holiday to more than RMB470 for an April delivery.

Vitamin B2 Leads Price Leap

According to reports, domestic manufacturers have recently raised vitamin B2 (80% concentration, widely used as a feed additive) price to RMB140/kg, an increase of 40% from the previous average price of RMB100/kg before the holiday. The prices of vitamin K3(MSB/MNB), biotin, vitamin B1 and other varieties have also soared. Vitamin K3 (MSB) is currently offered at RMB70-75/kg (some certain manufacturers even directly raise it to RMB110/kg), an increase of about 30% compared to RMB55 offered by Vanetta Chemicals before the festival holiday. The latest price of 2% biotin is 330-360 yuan / kg, and 158-180 yuan / kg before the holiday. The latest market price of VE is 68-71 yuan / kg, and the price before the holiday is 47-50 yuan / kg.

Vitamin industry has its own specialties in supply and demand pattern, 70-80% production capacity of most vitamin is concentrated in China, but approximately 70% of demand comes from abroad. The coronavirus epidemic situation has resulted in wide spread of delay in resumption of work. All are uncertain up to today, the trend of the epidemic, the impact on re-opening the factories, on logistics and transportation, and etc. These comprehensive factors have led to general rise in vitamins price and support to the prosperity of vitamins.

Vitamin industry has its own specialties in supply and demand pattern, 70-80% production capacity of most vitamin is concentrated in China, but approximately 70% of demand comes from abroad. The coronavirus epidemic situation has resulted in wide spread of delay in resumption of work. All are uncertain up to today, the trend of the epidemic, the impact on re-opening the factories, on logistics and transportation, and etc. These comprehensive factors have led to general rise in vitamins price and support to the prosperity of vitamins.

Source

Ronnick FONG, Executive Director at Hangzhou De Mark Industrial Co LtdRelated topics:

Mentioned in this news release:

Recommend

Comment

Share

Would you like to discuss another topic? Create a new post to engage with experts in the community.