China pork production: 2022 forecast

Published: September 15, 2021

By: China: Livestock and Products Semi-Annual. USDA, Foreign Agricultural Service. Global Agricultural Information Network (GAIN).

In 2022, hog production will decline by 5 percent due to low inventories and a smaller sow herd, which resulted from significant slaughter and delayed restocking in 2021. In 2022, government policies will disincentivize small- and medium-scale operations by controlling how quickly pork prices increase. Large, well-capitalized operations will benefit from other subsidy policies. As fewer small- and medium-scale operations remain in the market, the share of hogs produced by large-scale operations will continue to grow.

In 2022, hog production will decline by 5 percent due to low inventories and a smaller sow herd, which resulted from significant slaughter and delayed restocking in 2021. In 2022, government policies will disincentivize small- and medium-scale operations by controlling how quickly pork prices increase. Large, well-capitalized operations will benefit from other subsidy policies. As fewer small- and medium-scale operations remain in the market, the share of hogs produced by large-scale operations will continue to grow.Pork Production: In 2022, pork production will decline by 14 percent as fewer hogs reach market weight compared to prior years. In 2021, the slaughter of a significant number of overweight hogs boosted pork production and dramatically lowered pork prices during the first half of 2021. In 2022, government price controls will undermine hog and pork production. Consequently, Chinese pork exports will fall 10 percent to 90,000 metric tons (MT).

Pork Imports: In 2022, a tight pork supply will drive pork imports to reach 5.1 million MT (MMT). In 2021, significant slaughter increased pork production and frozen pork reserves. Higher consumer and institutional demand in the fall and winter months of 2021 will deplete frozen pork reserves. For this reason, pork imports are forecast to rise in 2022 as pork supplies tighten.

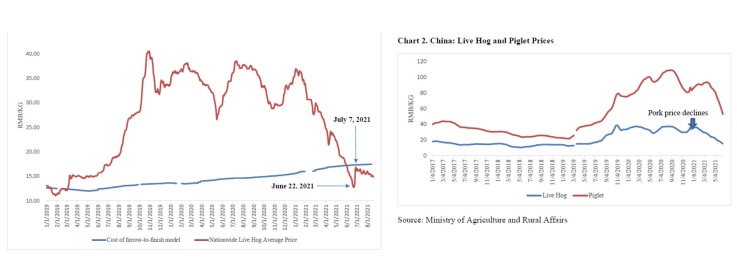

Price declines in early to mid-2021 were caused by African Swine Fever (ASF) outbreaks in China’s top three pork producing provinces and resulted in a rush to sell off hogs at all stages of maturity, including underweight, standard weight and overweight hogs. This sell-off occurred during the spring and summer months, a time of seasonally weak demand. The low demand and high supply of pork in the market exacerbated the price decline for both hog producers and breeders (see Chart 1 and Chart 2).

Source

China: Livestock and Products Semi-Annual. USDA, Foreign Agricultural Service. Global Agricultural Information Network (GAIN).Related topics:

Mentioned in this news release:

Elanco

Recommend

Comment

Share

Would you like to discuss another topic? Create a new post to engage with experts in the community.