Cargill Weighs Stand-Alone Bid for Feed Supplier Nutreco

Published: December 15, 2014

Source : Bloomberg News

Cargill, the grain exporter that’s the largest closely held company in the U.S., said it’s considering making a solo bid for Nutreco NV (NUO), a Dutch animal-feed supplier with a market value of about 3.2 billion euros ($4 billion).

“Cargill communicated to Nutreco that it remains interested in pursuing the acquisition of Nutreco and is looking into the potential of making an offer,” the Minneapolis-based company said in a statement. “We have asked Nutreco to give us access to due diligence,” Cargill said.

Nutreco has already attracted a $3.7 billion bid from SHV Holdings NV and earlier rejected a joint bid from Cargill and private equity firm Permira Advisers LLP. The maker of salmon feed is recommending the improved SHV offer equal to 44.50 euros a share after holding talks with the family-owned investment vehicle, Chief Executive Officer Knut Nesse said Nov. 10.

“Because Cargill doesn’t mention any price we could anticipate that Nutreco will decide not to open its books for this reason; no firm competing offer on the table,” CM-CIC Securities said by e-mail. “Unless Cargill discloses its intended offer price and more details on their takeover proposition, their offer could go hostile very quickly.”

Photographer: Nutreco NV via Bloomberg

Nutreco NV is recommending the improved SHV offer equal to 44.50 euros a share after... Read More

Nutreco, which makes Trouw livestock-nutrition products, is attracting takeover interest after the failed disposal in June of its compound-feed and meat business in Spain and Portugal. Animal nutrition is a current hotspot for mergers and acquisitions, drawing on growing global needs for foods amid limited resources such as water.

Nutreco NV is recommending the improved SHV offer equal to 44.50 euros a share after... Read More

Nutreco, which makes Trouw livestock-nutrition products, is attracting takeover interest after the failed disposal in June of its compound-feed and meat business in Spain and Portugal. Animal nutrition is a current hotspot for mergers and acquisitions, drawing on growing global needs for foods amid limited resources such as water.

Shares Rise

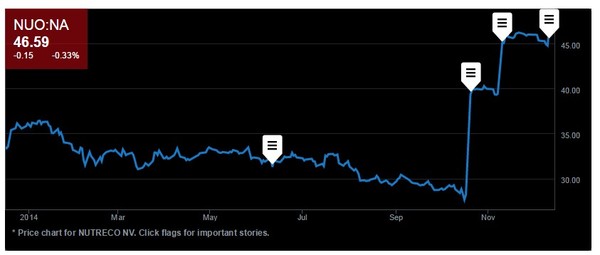

Nutreco rose as much as 4.5 percent in Amsterdam trading after Cargill’s statement. The stock was up 3.7 percent at 46.43 euros as of 10:41 a.m., taking the advance to 29 percent this year. Prior to SHV’s first offer, announced Oct. 20, Nutreco shares had dropped 22 percent in 2014.

“We have not received a concrete, written proposal that is likely to qualify or evolve to a competing offer,” Nutreco spokesman Mark Woldberg said in an e-mailed statement. “There is no doubt that it is clear to Cargill what will constitute a potential competing offer and what they need to do if they want to make a proposal that allows Nutreco to potentially engage.”

Source

Bloomberg NewsRecommend

Comment

Share

Would you like to discuss another topic? Create a new post to engage with experts in the community.