Compound Feed Market: Increasing awareness about precision nutrition techniques gaining significance

Published: July 18, 2019

By: www.marketsandmarkets.com

According to the Food and Agriculture Organization (FAO), compound feed is defined as “a mixture of products of vegetable or animal origin in their natural state, fresh or preserved; or products derived from industrial processing thereof, or organic or inorganic substances, whether or not containing additives, for oral feeding in the form of a complete feed.”

Animal feed plays a major role in the global food industry. It ensures safe and nutritious means of animal proteins and represents the largest input cost, of about 75% of the total cost for livestock producers, depending on the species. There has been an increase in demand for livestock products for domestic consumption from farmers and livestock rearers, with growth in awareness regarding the benefits of high-quality feed. The proportion of crossbred animals has also increased over the years, which has generated a higher demand for high-quality nutritional animal feed. The market for animal nutrition has also been changing considerably and is becoming competitive, owing to its major share in the pet care industry, which is, in turn, driving the global compound feed industry.

Precision Animal Nutrition (PAN) is the effective utilization of available feed resources, with the aim of maximizing the livestock’s response to nutrients. PAN is the process of providing the livestock with feed that precisely meets its nutritional requirements, for optimum production efficiency to produce better quality animal products, and to contribute to a cleaner environment and thereby ensure profitability. Due to these developments and findings, the role of compound feed in animal nutrition process is gaining significance. Well-balanced feed products are known to have a stable and clearly defined nutritional profile, a scientific mix of required ingredients, and an optimum mix of feed additives. They are also known for improving nutrient digestibility and helping the young adapt to the feed provided in the later stages. Owing to their nutritional profile, their optimum use in precision animal feeding techniques is desirable and productive, which would drive the overall market.

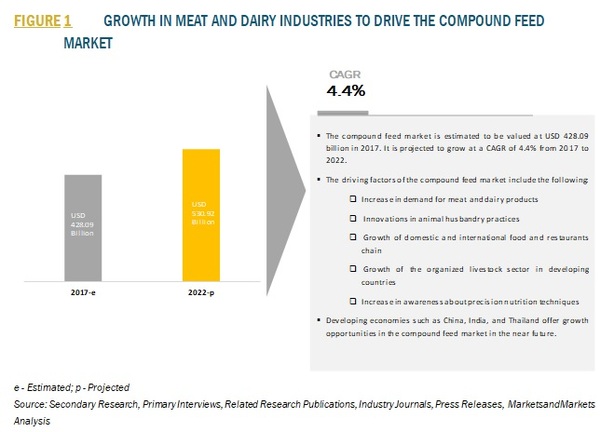

According to Markets and Markets, the global compound feed market was valued at USD 412.42 billion in 2016. It is estimated to reach about USD 428.09 billion in 2017; this is projected to grow at a CAGR of 4.4%, to reach USD 530.92 billion by 2022. In terms of volume, the global compound feed market stood at 1,007.13 MMT in 2016. It is estimated to reach about 1,024.76 MMT in 2017 and is projected to grow at a CAGR of 2.5%, to reach 1,159.39 MMT by 2022. The major drivers of the compound feed market are the increase in demand for meat and dairy products, innovations in animal husbandry, growth of domestic and international food and fast food restaurant chains, and increase in awareness about precision nutrition techniques.

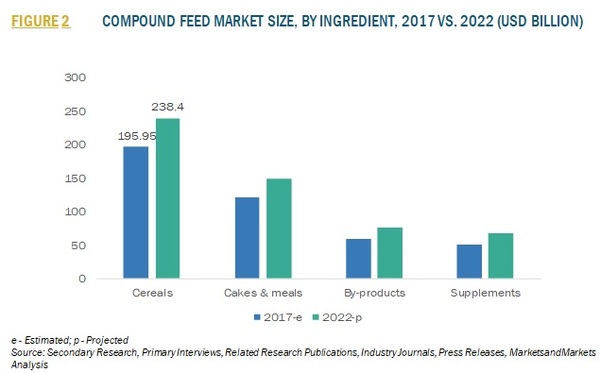

Cereals include cereal grains and distiller dried grains with soluble. Cereals are included in the feed to fulfill the nutrient requirements of the livestock around the globe. Globally, corn is the most widely used cereal in the feed. According to the Food Program of the Sustainable Table of GRACE Communications Foundation, corn is the most commonly used feed cereal for farm animals in the US, Brazil, and most of the Asian countries; whereas in Canada, Australia, New Zealand, and some European countries, wheat is the most widely used ingredient in the feed. The cereals segment dominated the market in 2016 due to the easy availability of cereals and the number of benefits, such as increased immune system and enhanced digestion system, they offer to animals.

The poultry segment is the fastest-growing market across all the regions

According to the Consultative Group on International Agricultural Research, by the year 2050, global poultry population is expected to surpass 35 billion, goat & sheep population will cross 2.7 billion, and cattle population will be over 2.6 billion. The poultry industry is one of the largest and also the fastest-growing sector, in terms of animal production. Layers; turkeys; broilers; and others such as ducks, emus, and ostriches that are domesticated to produce eggs and meat for commercial consumption are considered ‘poultry.' Poultry meat is universally consumed, and unlike beef and swine, is devoid of any religious constraints. The growing concerns about animal health and rise in awareness about the benefits of feed additives in feedstuffs have led to tremendous growth of this market.

According to the FAOSTAT, the US was the world’s largest chicken-producing country, followed by China and Brazil, in 2014. With the growth in poultry production and consumption, meat producers are focusing more on quality. This includes providing nutritional feed such as compound feed to poultry.

Asia Pacific estimated to be the dominant market

The value market for compound feed is estimated to be largely concentrated in Asia Pacific, followed by Europe and North America. The Asia Pacific region dominated the compound feed market in 2016, and this trend is projected to continue through the forecast period. It stood at USD 178.73 billion in 2016 and is projected to grow at the highest CAGR of 4.8% from 2017 to 2022. This growth is attributed to the rise in consumption of quality animal-based products, which subsequently increases the demand for feed. This, in turn, increases the awareness about the importance of quality feed such as compound feed among feed buyers. The region is an emerging market, with investments from several multinational manufacturers, in countries such as China, India, Thailand, and Japan, which are the major markets in the region.

Source

www.marketsandmarkets.comRelated topics:

Recommend

Comment

Share

Would you like to discuss another topic? Create a new post to engage with experts in the community.