Milk Protein Hydrolysate Market is set to surpass USD 1.3 Billion by 2025

Published: October 15, 2019

Source : https://www.gminsights.com/industry-analysis/milk-protein-hydrolysate-market

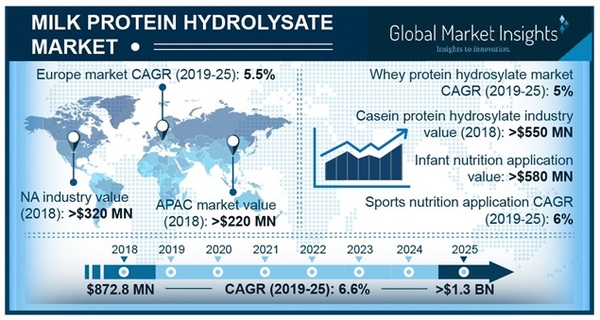

Milk Protein Hydrolysate Market is set to grow from its current market value of more than 850 million to over USD 1.3 billion by 2024; according to a new research report by Global Market Insights, Inc.

The extensive number of R&D programs on nutritional food & growing awareness about a protein-rich diet has helped milk protein hydrolysate market share soar to new heights. Nowadays, there has been a rapid surge in the demand for baby nutrition on account of the explosive population growth and the chaotic schedules working parents have to deal with. The need for reliable baby nutrition products at affordable prices and abundant availability has been influencing consumer buying behavior, thereby impelling the global milk protein hydrolysate industry share.

Next to breast milk, infant formulas are considered the best product for babies, for helping them build up their nutritional profile. In accordance, cow’s milk, considered to be rich in amino acids and other nutrients, is said to suit infants the best. In order to supplement the right nutrition for infants, formulas have been developed that are based on hydrolyzed cow milk proteins, that not only retain the excellent nutritional quality of these milk proteins but are also provided in a predigested form.

Given that milk protein hydrolysates not only help augment infant nutritional profiles but also help build up their physical strength, there has been an increased demand for the same to feed preterm infants. These proteins are also delivered to those infants that require a reduction in the gastrointestinal transit time so as to prevent common digestive ailments, in consequence, propelling the global milk protein hydrolysate market size from infant nutrition.

The demand for these hydrolysate products has also received a boost on account of certain recurring problems that infants face in the first few months. Prominent studies recognize infantile colic – excessive crying in a healthy baby, to be a common syndrome in the first few weeks of birth, that has been observed to have been resolved with the consumption of hydrolyzed formulas. The surge in the number of research studies validating the positives of hydrolyzed formula consumption for infants is bound to augment the commercialization scope of milk protein hydrolysates industry.

Statistics compiled by globally renowned organizations stand testimony to the fact that bringing hydrolyzed protein formulas for infants to the mainstream is an absolute necessity. According to the WHO, lesser/no nutrition is associated with 45% of child deaths under five. On the other hand, malnutrition impacts a significant proportion of infant populace – the UN claims that globally, 50.5 million children under five are wasted, 150.8 million are stunted, while 38.3 million are overweight.

As these numbers continue to proliferate across the globe, the milk protein hydrolysate market share is anticipated to experience a substantial increase. Also, a majority of companies are looking to adopt new innovative strategies to bring forth a slew of products that can have a positive impact on an infant’s metabolism, muscle function, immunity system, appetite, insulin sensitivity, and more. As these companies continue to launch healthier products, considering the soaring populace of working mothers and the robust need to eradicate malnutrition and other issues pertaining to infants, the global milk protein hydrolysate industry is bound to chart out a lucrative growth graph over 2019-2025.

Speaking of infants, it is vital to mention that Germany milk protein hydrolysate market size from infant nutrition is projected to cross USD 50 million by 2025, on account of the rising acceptance of infant nutrition products. Not to mention, the government has enforced strict regulations pertaining to the advertising and labeling of infant nutrition products, to ensure proper usage of breast milk substitutes, which may also help propel the regional milk protein hydrolysate industry outlook.

Many major industries have been striving to flood the market with innovative products so as to enhance their customer base and ensure that infants worldwide are fortified with the right nutritional products. Say, for example, Carbery Group, toward the end of 2017, launched an innovative product in the hydrolyzed whey protein range, called Optipep 4bars. Apparently, this new launch will be able to deliver a soft texture all through its shelf-life and also enhance the nutritional profile of the consumer. In the years to come, such product launches and other strategic tactics will come to characterize milk protein hydrolysate industry, slated to cross a valuation of USD 1.3 billion by 2025.

Source

https://www.gminsights.com/industry-analysis/milk-protein-hydrolysate-marketRecommend

Comment

Share

Would you like to discuss another topic? Create a new post to engage with experts in the community.

Featured users in Dairy Cattle

José Manuel Oropeza Meza

MSD - Merck Animal Health

Gerente Nacional Cuentas Clave en MSD Salud Animal

United States

United States