Summary

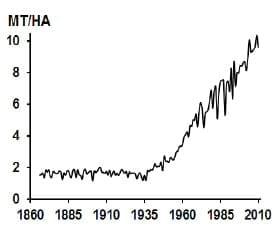

As governments around the world have mandated the use of corn, sorghum, wheat, soybean oil and rapeseed oil to produce biofuel, the prices of these commodities have become correlated with the price of petroleum. Use of biofuel limits dependence on imported petroleum and also reduces emissions of greenhouse gases as these fuels are renewable. Meanwhile, the overall demand for these crops for food and feed continues to rise with increasing global population and affluence. World population is expected to increase from 7 to 9 billion people by 2050. To date, agricultural production has kept pace with demand. Plantings and yields have increased substantially over the past 50 years in most regions of the world. Corn yields in the USA increased from 2 mt/ha/yr in 1950 to more than 10 mt/ha/yr in 2009. Traditional genetic improvement, irrigation, use of fertilizers and chemicals, farming practices and genetic modification have all worked in tandem to improve yields. About one-third of corn produced in the USA is currently converted to ethanol; the remainder is used as domestic and international animal feed and for corn sugar production. The EU has mandated that 10% of energy used for transportation will be achieved from agriculture by 2020. Grain and oilseed consumption for animal feed continue to increase every year. Prices for energy-rich feed grains will likely continue to increase in the future. Feed conversion efficiency has improved with advances in animal genetics and ingredient processing. Rapid nutrient measurement techniques using near infra-red reflectance spectrometry and net energy diet formulation promise to further enhance efficiency.

Introduction

The world´s growing population and higher incomes will significantly boost food and meat consumption in emerging economies. Demand to convert starches and edible oils into biofuels will continue into the foreseeable future. This scenario will place an unprecedented demand on grain and oilseed production. Ever more efficient production and use of these commodities are warranted. Changing climatic conditions may result in sporadic crop failures, causing stock shortfalls with drastic price spikes in the future. Drought conditions were experienced in the wheat-growing areas of Australia from 2003 to 2009, followed by floods in early 2011. Russia experienced severe drought and fires in 2010, resulting in a poor wheat harvest. Wheat production in China continues to be affected by the drought that started in 2008. While El Niño (warming) events in the equatorial East Pacific Ocean increase the possibility of drought in Australia and Asia, they do not appear to have a predicable impact on drought in North American grain-growing areas. Severe drought has not occurred since 1988 in the USA, currently the world´s largest grain and oilseed producer and exporter. Improved farming practices, water management and irrigation have, and will continue to mitigate the potential effects of drought. Adoption of biotechnology has reduced the need for tillage and the ravages of insects and weeds. This has greatly contributed to a stable balance between supply and demand for grains and oilseeds. Developments in oilseed processing technology have shown promise for increasing the digestibility of energy and amino acids (Newkirk et al., 2003; Karr-Lilienthal et al.,2005; Neoh, 2009). Formulation of animal diets on a net energy basis will enable more precise balancing of nutrient inputs with requirements by taking into account energy lost as heat. The purpose of this review is to discuss trends and technology affecting the supply and demand of grains and oilseeds used in the feed industry.

Grain and oilseed supply trends

The feed industry will not run out of raw materials in the foreseeable future. However, raw material prices may test new limits, especially if weather events that limit production of corn in the USA occur. The floor price of corn and other energy crops is also likely to creep up over time. During the economic crisis in 2008, the price of corn in Chicago was more than US$6 per bushel (US$ 236.21 per mt) for 5 weeks and spiked up to nearly $7/bu ($275.58/mt) in June of that year. The price plummeted to less than US$ 3.44/bu in June of 2008 and remained low until late 2010. From 2007 until 2011, Chicago corn prices averaged $4.52/bu and recently reached an historical high of $7.96/bu in May of 2011. It is likely that corn prices will remain high during 2011 and 2012. Wet weather has made early planting difficult in some regions of the USA and potentially dry conditions later in the year due to a lingering El Niña event may negatively affect yields. With such strong global demand for feed and competition from ethanol producers, the price of corn may never again be as low as it was in 2008. Expiration in December 2011 of the $0.45 per gallon tax credit for blending ethanol into gasoline enjoyed by the oil companies and removal of the $0.54 per gallon tariff on imported ethanol in the USA may result in some downward pressure on corn prices. The outcome of the USA budget debate and public awareness of the link between food cost and ethanol production will likely help keep credits and tariffs from being reinstated at current levels. Predicting the future is difficult at best – watch the weather in the USA Corn Belt!

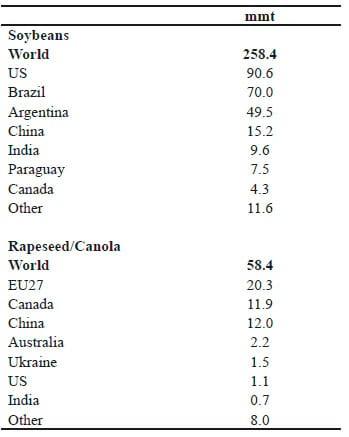

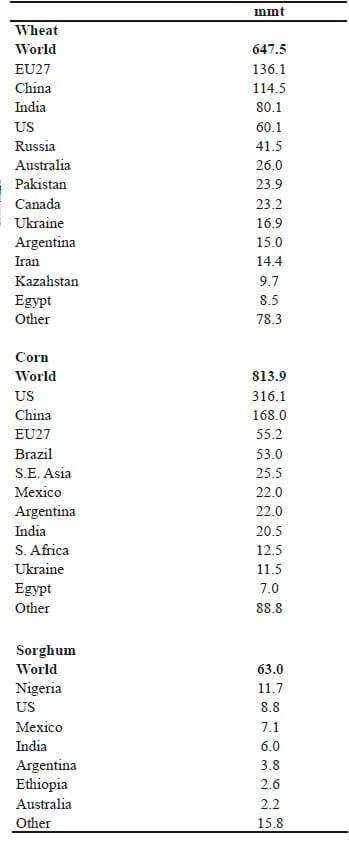

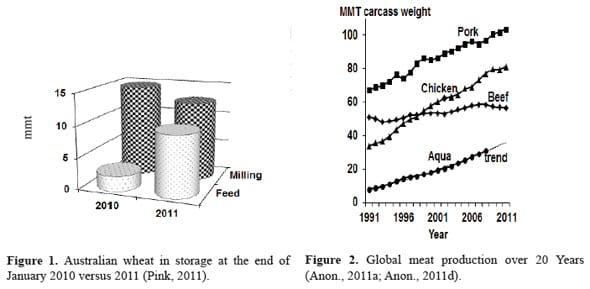

Table 1 shows the forecast production of wheat, corn and sorghum for the main production countries. Wheat production is widely dispersed around the world with China and the EU producing the largest quantities. Forecasts suggest that a large portion of the 2010/2011 global wheat harvest (about 20%) will be used as animal feed. Wet harvest conditions in Australia are one reason for this. Figure 1 shows the amount of Australian wheat destined for feed ("sprung and shot") and food in 2010 vs 2011 (Pink, 2011).

Table 1. USDA 2011 global grain forecast (Anon., 2011c).

Corn production is dominated by the USA, followed by China. The USA is forecast to produce 39% of the global supply in 2010/2011, representing 56% of global corn trade. The USA share of corn trade is expected to increase steadily to 60% by 2015 and to decline to 53% by 2020 as production and exports from Brazil, Ukraine, EU and Argentina increase (Westcott et al., 2011). Although China is the second largest corn producer, it may soon become a net importer of corn or other substitute feed grains.

Sorghum is an important grain that can be grown in regions drier than those suitable for corn but its production is about 10% of that of corn. The major sorghum producers are Nigeria, USA, Mexico and India. The USA is projected to remain the largest exporter of sorghum. However, during the past decade, USA sorghum acreage and production have declined because of lower net returns compared with corn and soybeans. Sorghum exports from Argentina, the world´s second-largest exporter, and from Australia have risen sharply in the past few years. Both countries are expected to remain prominent exporters during this decade (Westcott et al., 2011).

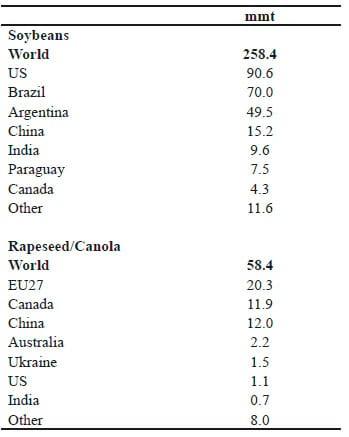

Table 2. USDA 2011 global oilseed forecast (Anon., 2011c).

Table 2 shows the global production of major oilseeds. Although soybeans are indigenous to China, 81% of soybeans are currently produced in the Americas, viz., the USA, Brazil, Argentina and Paraguay. Soybean production and trade has risen sharply during the past 10 years due to growth in the Asian feed industry.

Rapeseed/canola production is dominated by the EU, Canada and China. Total global production of this oilseed is about 20% of that of soybean. Rapeseed contains about 42% oil, whereas soybean contains about 19% oil. Rapeseed production is increasing greatly in the EU because of its use as a feedstock for the production of biodiesel.

Grain and oilseed demand trends

Demand for coarse grains and oilseed products is dominated by the animal feed industry. Figure 2 shows the global production for meat and aquaculture products over the past 20 years (Anonymous, 2011a; Anonymous 2011b). Pork has led the way with steady increases each year. China now leads the world in the production of pork and aquaculture products. The USA leads the world in poultry production with Brazil catching up quickly. Total demand for beef remained flat in the 1990s and 2000s, indicating that beef consumption has lost significant market share.

Food consumption habits in developing economies change when per capita annual gross domestic product surpasses $1000, and consumption of meat, dairy, eggs and fish increases sharply (Grainger, 2002). In many Asian and Middle Eastern countries, per capita income levels have more than doubled over the past two decades. Countries in which per capita income has increased from $500 to $5000 have rapidly growing feed industries if there is economic growth and a stable political system. Local production of raw materials and a lack of trade barriers are considered beneficial for the feed and animal production industries. When income exceeds US$10,000 per capita, meat consumption plateaus and additional income does not have a great effect on the food consumption pattern.

Although purchasing power has increased for almost everyone in the world over the past decade, patterns of household spending on food differ greatly between high- and low-income countries. Bread and cereals account for 12% of food expenditure in highincome countries and for 27% of food expenditure in low-income countries. It has been estimated that a 10% increase in income would result in a 1% increase in food expenditure in the USA, a 6.5% increase in food expenditure in the Philippines and an 18% increase in food expenditure in Tanzania (Seale and Bernstein, 2003).

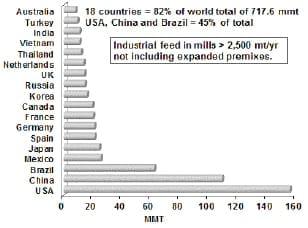

Figure 3 shows that the top 18 feed-producing countries accounted for 82% of the total production of 708 mmt in 2010 (Best, 2010). According to the World Feed Panorama survey conducted by Feed International, global industrial feed production grew by 1.4% in 2009. The increase was smaller than expected (2%), which was likely due to limitation of animal producers´ expansion plans by higher than expected grain prices. For some large feed producers such as Charoen Pokphand Foods Plc, 2010 was a banner year in which profit margins surged by more than 30% according to news reports (Suwannakij, 2011).

Figure 3. Global industrial feed production in 2010 by country (Best, 2011).

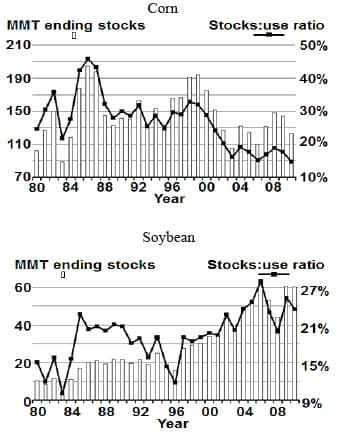

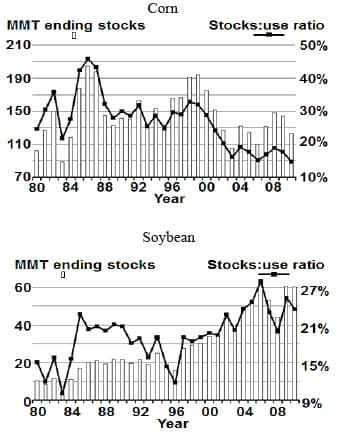

Figure 4 shows historical ending stocks and the stocks-to-use ratios for corn and soybeans. A lower stocks-to-use ratio indicates a tendency for increasing prices. Several factors have contributed to the recent increase in grain and oilseed prices. A severe drought in Russia and Central Asia decreased wheat harvests in 2010. In late summer 2010, heavy rain fell on mature wheat crops in Canada and north-western Europe, reducing the quality of much of the crop to feed-grade wheat. Late 2010 and early 2011 rains in Australia reduced and downgraded much of the Australian wheat crop to feed quality, reducing global supplies of foodquality wheat. Petroleum prices also increased with improvements in the global economy. The run-up in crop prices during the last half of 2010 is expected to stimulate increased plantings and more intensive use of production inputs in 2011. Assuming average weather in the major grain-producing regions in 2011, global production and world stocks of grains and oilseeds are projected to increase. However, even with the projected increases in world crop production and stocks, world market prices are expected to remain well above historical levels for the next decade (Westcott, 2011).

Figure 4. World corn and soybean ending stocks and stock to use ratio (Anon., 2011b).

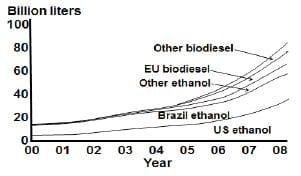

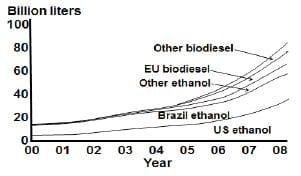

Biofuels represent a growing demand segment for both grains and oilseeds. At present, over 90% of biofuel is ethanol. Corn, wheat, sorghum and sugar cane juice are all used to produce ethanol. Carbon dioxide and dried distillers´ grains and solubles (DDGS) are co-products. The ethanol is blended with gasoline to reduce reliance on fossil fuels and decrease net production of greenhouse gas. Ethanol produced from sugar cane is economically feasible when crude oil prices are greater than US$45 a barrel (Simbolotti, 2007). Ethanol produced from grain requires various government subsidies or "blending credits" to remain competitive with gasoline. Edible oil from various oilseed crops or restaurant waste can be used to produce biodiesel. The process involves trans-esterification and requires addition of methanol (from petroleum) to generate fatty acid methyl esters with removal of glycerol. Figure 5 shows that global biofuel production tripled from 2000 to 2008 (Eisentraut, 2010). Much of the increase consisted of ethanol production from corn in the USA. It is predicted that second-generation biofuels, including biomass and algae, will be used in the future. Conversion of biomass to liquid biodiesel has been demonstrated using the Fischer–Tropsch thermochemical synthetic fuel generator. The Petro Algae Company has demonstrated successful production of renewable hydrocarbon feedstock from algae that can be efficiently converted to diesel, jet fuel and other fuel products using the existing refinery infrastructure. These new technologies promise to reduce the usage of grains and oilseeds as raw materials for biofuel in the future.

Figure 5. Global biofuel production, 2000 to 2008 (Eisentraut, 2010)

Future grain and oilseed supply

The USA and other producers have the capacity to produce more grain (corn, wheat, sorghum) through yield enhancements, but new grain growing land is becoming scarce. Ukraine and countries in southern Africa have potential to develop more grain crop land. Grains and edible oils will likely remain expensive until new second-generation technology is developed to produce biofuel. The supply of low energy, high protein and high-fibre ingredients such as DDGS, soybean meal and canola meal will increase with continued production of biofuel.

Brazil has the capacity to expand production by opening vast tracts of land to soybean production. The area of potentially available new land in Brazil is equivalent to the area of all of the cultivated land in the USA. As such, it has the capacity to produce an additional amount of soybeans equivalent to that currently produced by the USA (M Sato, pers. Comm.). New varieties that are resistant to soybean rust will increase the lead of Brazil as the major exporter. The EU will remain a major importer of soybean meal with growth markets in Latin America, North Africa, Middle East, China, Southeast Asia, Russia, Central Europe and Eastern Europe. Brazil and Argentina will increase their share of soybean meal exports and the USA will experience an erosion of its share. Value-added highnutrient soybean meals will emerge where technology and transport systems allow for measurement, segregation and inspection.

Trade in soybeans will increase in coming years as China imports ever more beans from Brazil and to a lesser extent from the USA. China has now surpassed the EU as the largest soybean importer in the world and represents more than 50% of the soybean trade. China is no longer a net corn exporter and it appears that China will attempt to remain self-sufficient in corn at the expense of growing soybeans. As the EU produces more biofuel from rapeseed oil, rapeseed meal will replace soybean meal in animal diets.

Technologies to improve supply and economize demand

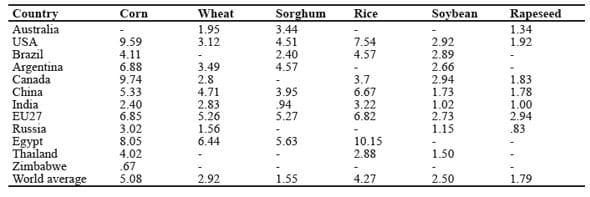

Genetic enhancement of crops has had notable effects on yield. Figure 6 shows the progress in corn yields made in the USA since 1866 (USDA, 2011). Major and Ramankutty, 2004). Although the average corn yield in the USA is now about 10 mt/ha, the highest yield recorded is double the average. This strongly suggests that future improvements are possible. Table 3 shows average crop yields for selected countries. There are great opportunities to enhance yields using water management, genetic selection and improved farming practices. Corn yields and harvests in Zimbabwe have ped threefold in the past 10 years because of deteriorating farming practices and poor Government policies. Southern African countries have the potential to grow grains and oilseeds due to favourable climate and rainfall patterns. To this end, China is currently funding canal and irrigation projects in Mozambique.

Figure 6. Historical US corn yields (Anon., 2011c).

Table 3. Average crop yields (mt/ha) for selected grain and oilseed producers (Anon., 2011c).

Genetically modified corn and soybeans were first introduced in the USA in 1996. Today over 80% of corn and soybeans grown in the USA are genetically modified. Herbicide resistance in corn and soybeans enables application of glyphosate, a safe and effective herbicide. This technology enables the farmer to plant seeds without the need for tilling. This reduces fuel consumption on the farm and gives easier access to the fields. Tillage reduction significantly minimizes the output of greenhouse gases from the soil. Corn expressing the gene for the insecticidal Bacillus thuringensis protein improves resistance to the European corn borer and other insects. The requirement for application of persistent insecticides is thus reduced.

Acceptance of transgenic crops with improved nutritive value has the potential to reduce overall demand, keep prices in check and reduce demands on the environment associated with the production of more crops. Soybean varieties that are high in protein and essential fatty acids and low in trypsin inhibitor and phytate have been developed and will be commercialized when they have been thoroughly tested and deemed acceptable. Digestibility of amino acids and phosphorus were found to be greater in soybean meal produced from low phytate beans relative to conventional soybean meal (Karr-Lillienthal et al., 2005). In another study by Parsons (2005), soybean meal produced from genetically modified soybeans (M703; Monsanto Company, St Louis, Missouri, USA) had considerable advantages over conventional soybean meal in terms of digestible amino acid and metabolizable energy content.

Poultry and pig genetics have had a tremendous impact on reducing the consumption of grains and oilseeds over the years. Broilers are now capable of growing to 2 kg by consuming only 3.2 kg of feed. Twenty years ago, the same broiler would have required 4.1 kg of feed. Assuming that an average of 52 mmt of live broilers were produced each year during the past 20 years using a diet consisting of 65% grain and 25% oilseed meal, improved broiler genetics has saved in excess of 291 mmt of grain and 112 mmt of oilseed meal over this period.

Feed formulation using a net energy system holds promise for improving the efficiency of poultry production. This system has been in use in the pig and ruminant industries for many years to decrease feed consumption and carcass fat content. Nutrients present in feed ingredients are used with varying efficiencies depending on the amount of energy "wasted" as heat during metabolism. The current metabolizable energy system overvalues the energy present in oilseed meals and high-fibre ingredients such as DDGS and undervalues the energy present in high-fat ingredients and synthetic amino acids. The net energy system is also suitable for broilers because most modern broilers are grown under thermoneutral conditions in climatecontrolled sheds. Net energy values can be calculated using equations described by Emmans (1994) or respiratory quotients obtained from experiments using live animals in respiration calorimeters.

Conclusions

The animal feed industry is an integral and growing segment of the food supply chain. It supplies the raw materials needed to produce healthy animals that provide essential human food protein and energy. Animal products are a vital and important food source for the world´s growing population of 6.9 billion people. Increasing broad-based income growth and urbanization are changing eating patterns and resulting in increased meat consumption. Industrial feed production in mills producing more than 2,500 mt per year is currently 718 mmt per year. The average growth in animal feed production is about 2% per year. If future demand increases at this rate, the supply of raw materials would cover demand for the next 10 years. The feed industry will likely experience more tightness and higher price spikes in coarse grains as ethanol production increases and China becomes a net importer of corn. Advances in the production of second-generation biofuels from biomass will help ease the demand for grains in the future. Soybean production will continue to increase in Brazil and Argentina. Transgenic crops with increased nutrient content may gain acceptance in the future. Adoption of the net energy system for broiler feed formulation will improve feed efficiency. The feed industry will continue to be dynamic and will be punctuated by major technological developments.

References

Anonymous (2011a) Livestock and poultry: world markets and trade. USDA-FAS. www.fas.usda.gov/psd

Anonymous (2011b) Global Aquaculture Production 1950-2008. Food and Agricultural Organization of the United Nations. http://www.fao.org/fishery/statistics/global-aquacultureproduction/query/en (accessed on 16 March,2011).

Anonymous (2011d) CME Agricultural products. http://www.cmegroup.com/trading /agricultural/grainand-oilseed/soybean_learn_more_reports.html (accessed on 16 March, 2011).

Anonymous (2011c) Production, supply and distribution online. http://www.fas.usda. gov/psdonline/psdHome.aspx Assessed on 16 March 2011. Best P (2010) World feed panorama: expensive grain slows expansion. Feed International December 10, 2010. http://www.wattagnet.com/World_Feed_Panorama__Expensive _grain_slows_industry_expansion.html (accessed on 16 March, 2011).

Eisentraut A (2010) Sustainable production of second generation biofuels: Potential and perspectives in major and developing countries. International Energy Agency. http://www.iea.org/papers/2010/second_generation_biofuels.pdf (accessed on 16 March, 2011).

Emmans GC (1994) Effective energy: a concept of energy utilization applied across species. British Journal of Nutrition 71, 801-821.

Grainger R (2002) World review of fisheries and aquaculture. Fisheries Resources: Trends in Production, Utilization and Trade. The State of World Fisheries and Aquaculture 2002. FAO. http://www.fao.org/docrep/005/y7300e/y7300e04. htm (accessed on 16 March, 2011).

Karr-Lilienthal LK, Utterback PL, Martinez-Amezcua C, Parsons CM, Merchen NR, Fahey GC Jr (2005) Relative bioavailability of phosphorus and true amino acid digestibility by poultry as affected by soybean extraction time and use of low-phytate soybeans. Poultry Science 84, 1555-1561.

Kucharik CJ, Ramankutty N (2004) Trends and variability in U.S. corn yields over the twentieth century. Earth Interactions 9, 1-29.

Neoh SB (2009) High efficiency soybean meal allows significant savings. Asian Poultry Magazine, May 2009.

Newkirk RW, Classen HL, Edney MJ (2003) Effects of prepress-solvent extraction on the nutritional value of canola meal for broiler chickens. Animal Feed Science and Technology 104, 111-119.

Parsons C (2005) Is there a future for GE crops beyond 2010? Proceedings of the 3rd International Broiler Nutritionists Conference. Poultry Industry Association of New Zealand.

Pink B (2011) Wheat stocks and use. Report 7307. Australian Bureau of Statistics, Canberra, Australia. http://www.ausstats.abs.gov.au/ausstats/subscriber.

nsf/0/701D376502D10F1FCA25784E0017D511/$ File/73070_january%202011.pdf (accessed on 18 March, 2011).

Seale AR, Bernstein J (2003) International Evidence on Food Consumption Patterns. TB1904, USDA Economic Research Service, October 2003.

Simbolotti G (2007) Energy Technology Essentials, Biofuel Production. Report ETE02, International Energy Agency. http://www.iea.org/techno/ essentials2.pdf (accessed on 18 March, 2011).

Suwannakij S (2010) Charoen Pokphand says profit may grow more than 30%. Bloomberg News. http:// www.bloomberg.com/news/2010-11-10/charoenpokphand-

says-profit-may-grow-more-than-30- update1-.html (accessed on 17 March, 2011).

Westcott P, Trostle R, Stallings D (2011) USDA Agricultural Projections to 2020. USDA Office of the Chief Economist, World Agricultural Outlook, Long Term Projections Report, OCE-2011-1, Feb 2011. http://usda.mannlib.cornell.edu/usda / ers/94005/2011/OCE111.pdf (accessed on March 16, 2011).

This article was originally published in Recent Advances in Animal Nutrition- Australia Volume 18 (1-7). Engormix.com thanks the author and the organizing committe for this huge contribution.

.jpg&w=3840&q=75)

.jpg&w=3840&q=75)