Animal Feed Prices

Animal Feed Prices under Severe Bout of Inflation- Part I

Published: August 14, 2012

By: Dr.Shirish Nigam and Dr. Zafar Ahmad

Feed ingredients have witnessed an unprecedented rise in the prices in recent times. Current scenario of poultry industry demands a paradigm shift in the approach and attitude towards successful and sustainable business model which has least impact of such situations in near future. Contemporary poultry business model is thriving on the demand side factors which involve complete dependency on the swelling consumption of poultry products (egg & meat) & increased price realization on poultry products. The biggest problem with this model is that after certain limit buyer resistance comes into play which forces the poultry businesses to decrease the prices making business unviable and uneconomical. The need of the hour is to revisit the approach by integrating supply side factors into existing poultry business model. In this article we would be majorly focusing on soya other feed ingredients will be covered in subsequent articles.

Ever increasing prices of poultry feed ingredients has thrown a challenge to the industry about how can we de-risk the business? Many underlying reasons have led to this sharp rally in the prices which has put a severe pressure on poultry industry leading to a state of crisis. The major components, Energy source (Maize, Bajra, other grains) and Protein source (Soya, GNC, MBM etc.) which constitute almost 85-95% of feed have undergone heavy rise in prices.

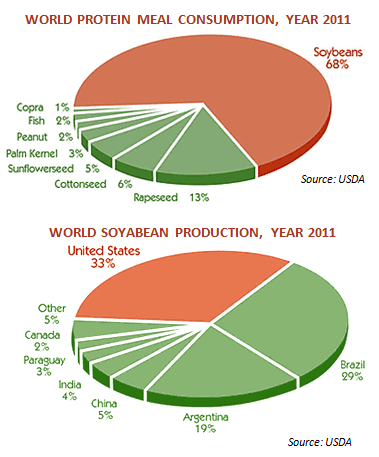

Soyabeanbeing a major protein source for poultry has seen a tremendous rise in the prices across the globe in last 7-8 months. 68% (177 million MT) of protein meal utilized for animal feed in the world is contributed by soyabean, thus making it an utmost important protein source. Soyabean demand is on constant rise due to its high quality protein content which meets the optimum requirement of animal feed.

Looking at the global production scenario, 251 million MT (mMT) of Soyabean was produced in 2011 where United States was major producer (83 mMT) followed by Brazil (72 mMT) & Argentina (48 mMT). India produced only about 4% (11 mMT) of the world’s Soyabean. The major global consumer of Soyabean is China, followed by US & Brazil, thus making China the biggest importer. China imports about 65% of the world’s exportable supplies of Soyabean.

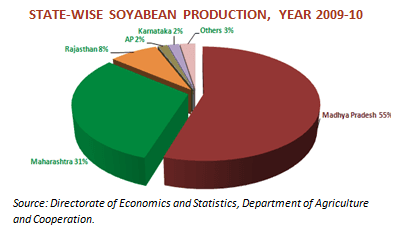

Indian scenario reveals that soyabean crop is restricted to few states especially in central and western parts of India. Madhya Pradesh is major producer with more than 50% production, followed by Maharashtra (31%), Rajasthan (8%), AP (2%), and Karnataka (2%). Though introduced only in 1970-71, Soyabean has emerged as a successful cash crop with 200% increase in the yield.

Soya Meal Production Trend in India

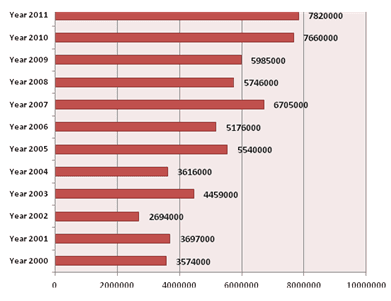

Soya meal production has been under huge demand due to rapidly developing and transforming landscape of poultry industry in India. Soya meal production doubled from 3.5 mMT to 7.8 mMT within a decade under domestic and export demand influence. India has emerged as a significant exporter of soya meal globally with 4.3 mMT of exports in 2011, putting exports to 55% of total soya meal produced in the country. Globally, though India produces only 4% of world’s soyabean but it contributes to 7% of soya meal exports. This has made soya as a preferred cash crop of central and west India.

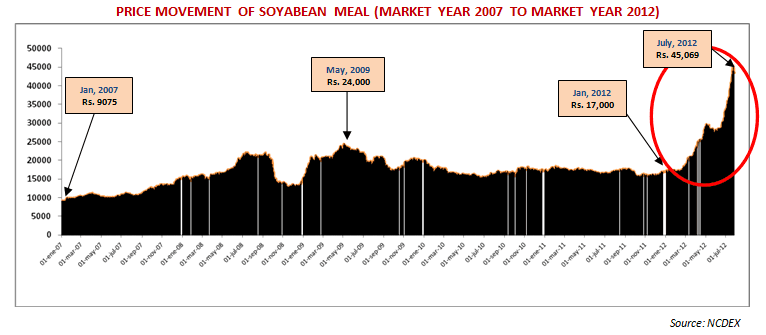

Price Trend of Soya Meal in India

Among the feed ingredients, soya meal is the worst hit with price rise of more than 160% in a period of 7 months putting a huge pressure on poultry industry.

There are numerous underlying reasons for this sudden spurt;

- Declaration of drought in top soya producing countries like US, Brazil and Argentina

- Shift in agricultural pattern of farmers in major producing countries from soya to corn for ethanol production

(Almost 1 million acres of soybean cultivation in the U.S. farmers switch to corn in 2010-11)

- Deficit rainfall in India with drop in production

- Forward trading & speculation

- Holding of stocks by stockists due to poor rainfall

- Sanctions on Iran by US followed by increased exports of soyameal to Iran by India

(Record rise in soyameal exports to Iran from India, 174% rise in exports June in comparison to May)

- China emerging as a large buyer and causing supply in global market to decline

The Way Ahead

Indian soyabean market is worth more than INR 5000 crores (US $1 billion) mainly driven by heavy domestic as well as export demand for soyameal. Consequently, soyameal production in India has grown at CAGR of 7.8% in last decade (Year 2001 to Year 2011). Indian soyameal is very competitive in global landscape owing to its cheaper price in comparison to American & Brazilian soyameal and non-GM crop status.

Credit to robust and increasing soyabean production in India goes to increased crop acreage rather than any significant progress in the yields. Though yield has grown by 200% in India from 0.42 Mt/ha in 1970 to 1.32 Mt/ha in 2011, it is nowhere in comparison to world average of 2.40 Mt/ha or Argentina’s average of 2.74 Mt/ha.

With an impressive CAGR of 7.2% in soyabean production & 8.6% in soyameal production in a period of last 5 years starting from 2006 to 2011, coupled with enhanced productivity due to improved agronomical practices (High yielding seed varieties, better irrigation practices, improved agri-inputs etc) in future will definitely result in excellent soya production. Also looking into rapid progress of poultry industry, which consumes more than 60% of soyameal, minimum CAGR of 6% for next 3 years (2012-2015) for soyameal is quite plausible.

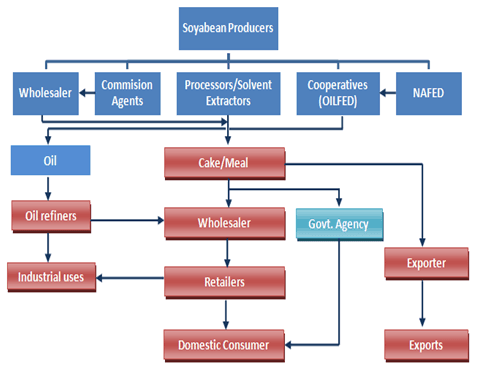

Assurance on the part of higher soyameal production in India is quite evident considering the past scenario. But the insurance on pricing of soyameal will be the biggest factor deciding the success of poultry industry per se. To ensure that the poultry businesses do not succumb to the situations of rapid price increase in future, there is a requirement of developing alternate models. Soyameal value chain is unique wherein processors/solvent extractors have a major say. Processors/Solvent extractors are the major stakeholders in deciding the prices of soyameal. The following are best possible options that can help poultry businesses to insulate themselves against unprecedented price rise situations.

Option 1 – Backward Integration: Possibly by jumping up the value chain, a higher control over the prices can be exerted. Feed millers, integrators, large poultry farmers can install soya crushers at the major soya production zones of like Central/West India. By installation of soya crushers, a higher command over the prices is possible alternatively the firm should also develop its expertise into oil and other soya byproducts marketing and sales.

Option 2 – Contract Farming: This model can be a highly suitable for the feed ingredients which go directly into the feed without undergoing much processing like grains such as maize, bajra, ragi, broken wheat, broken rice etc. Many states have amended their APMC acts to allow contract farming, thus providing a win-win situation both for the farmers and the customers. The poultry businesses can have pre-harvest contract with farmers under a pre-determined and agreed price, thus ensuring price rise insulation in near future. This model can be extrapolated for soyameal by integrating the crushing facility with soyabean farmers.

In conclusion, we can say that this crisis situation has been a definite eye-opener for poultry industry. It has thrown open the industry to price vagary and demands a long term sustainable strategy. Such circumstances will help bring out the best in industry with resultant unique & innovative supply chain models.

Related topics

Authors:

Join to be able to comment.

Once you join Engormix, you will be able to participate in all content and forums.

* Required information

Would you like to discuss another topic? Create a new post to engage with experts in the community.

Create a post3 de febrero de 2014

Is it or not advisable to feed on small scale, the fly's and their larwa from the normal fly catchers that hangs around the farm, wil it bring sickness to the chickens I have only like 800 per week chickens in 6 sheds, all this to help feeding cost I am from South Africa.

.jpg&w=3840&q=75)